A net zero digital financial services super app for the Indian diaspora in the UK, Gibraltar and India.

Overview

Ribbon PLC targets opportunities arising from the cross-border banking needs of the Indian diaspora in the UK and increasing bi-directional flows of capital flows between the two countries.

INVEST WITH US%20(1)-1%20(1)%20(1).jpg)

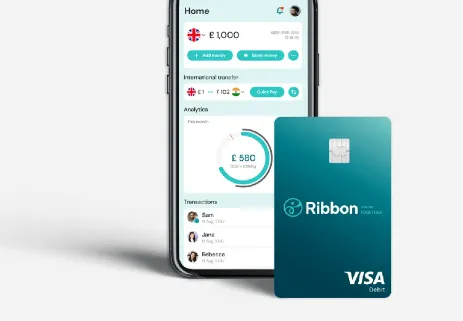

- Ribbon brings a suite of banking and money management tools to the global Indian.

- The company will provide hyper-personalised services to its customers by aggregating various service providers to offer multi-currency wallets, money management tools, AI-based analytics, virtual and physical debit cards, FX and stock trading platforms and wealth management.

- MVP launched in Q3 2022.

- In the process of obtaining third party EMI licence to launch by Q4 2022.

Impact

Carbon neutral fintech that promotes financial inclusivity.

Planet

- As a prerequisite to service our clients, Ribbon is dedicated to being carbon-neutral, providing the possibility for impact investment.

- Ribbon cards will be made from degradable plastic and the platform will invest in projects to divert plastic bottles and plant trees in line with their customer base’s spending patterns.

People

- Serving and collaborating with stakeholders in a socially responsible manner by delivering a healthy work environment for our team and ensuring fair supplier treatment.

- Providing an open platform which integrates the best financial instruments all-in-one app, giving financial freedom and power back to customers to spend smart, save more and grow their money.

Profit

- Revenue £130/customer in Year 5.

- PAT £35.6mn and EBITDA Margins of 60.3% in Year 5.

- ROI of 5x in 5 years.

The Team

Anup Ratnaparkhi

Chief Commercial Officer

- Anup is an accomplished Retail Banking professional with over 14 years of rich experience in driving Retail Banking Business, developing sales and distribution channels, building partnerships and alliances and managing product and segment level P & Ls.

- Prior to joining Ribbon, he was heading the Branch Banking and NRI Business for ICICI Bank UK PLC.

Anup Ratnaparkhi

Chief Commercial Officer

Ashesh Jani

Chief Executive Officer

David Oxley

Human Resource Manager

Manish Vaid

Head of Channels

- A result driven professional with extensive experience in Business Development, Marketing and Product Management.

- Manish has set-up numerous distribution networks for Financial Products and enjoys a deep understanding of customer segments and their financial goals.

- In his professional career, Manish was Head of Bancassurance & International Business for Kotak Life Insurance (India); and Head of Marketing & New Account Acquisitions for ICICI Bank UK PLC.

Manish Vaid

Head of Channels

.webp?width=223&height=223&name=Marcus%20Wohlrab-2%20(1).webp)

Marcus Wohlrab

Non-Executive Director

Nuria Harjani

Non-Executive Director

- Nuria Harjani has more than ten years’ experience within corporate and business development for financial services, E-money and Fintech companies

- She brings a carefully crafted network of professionals and entrepreneurs across several major industry sectors in Gibraltar, along with a driven work ethic to her role as NED for Red Ribbon Plc

Nuria Harjani

Non-Executive Director

Rajesh Radhakrishnan

Chief Technology Officer

Riddi V Viswanathan

Channel Manager

- Riddi Viswanathan is a serial entrepreneur and a former student leader who has worked extensively with students, educational institutions and Higher education policy bodies in the UK-India education corridor.

- As an advocate for youth representation and inclusion, Riddi has represented young people at the Houses of Parliament Westminster, European Parliament- Brussels and has been invited by leading media houses including the BBC, New York Times, NDTV, The Hindu for her opinions.

Riddi V Viswanathan

Channel Manager

Salamullah Syed

Head of Digital

Suchit Punnose

Chairman and Co-Founder

Yashodhara Khajuria

Senior Associate

Invest with us

If you align with our investment values and goals, we welcome you to invest with us. Please fill out the form and our team will reach out to understand your needs as an investor and share more details about Ribbon Plc.

Capital at risk. Investments of this nature carry risks to your capital, including lack of liquidity, lack of dividends and dilution. Balance risk with a diversified portfolio. Please seek independent advice as required as Ribbon Plc does not give investment or tax advice. Suitable only for sophisticated or high net worth investors.

.webp)